Yiğit Ihlamur is the co-founder of Vela - The world's first product-led and AI-native venture capital firm. AI-only portfolio since 2017.About Vela

Vela Partners is a San Francisco based venture capital firm that embraces a product led approach and is deeply integrated with artificial intelligence. Founded in 2016 by former Googlers and experienced entrepreneurs, Vela focuses on constructing a portfolio solely driven by AI innovations.

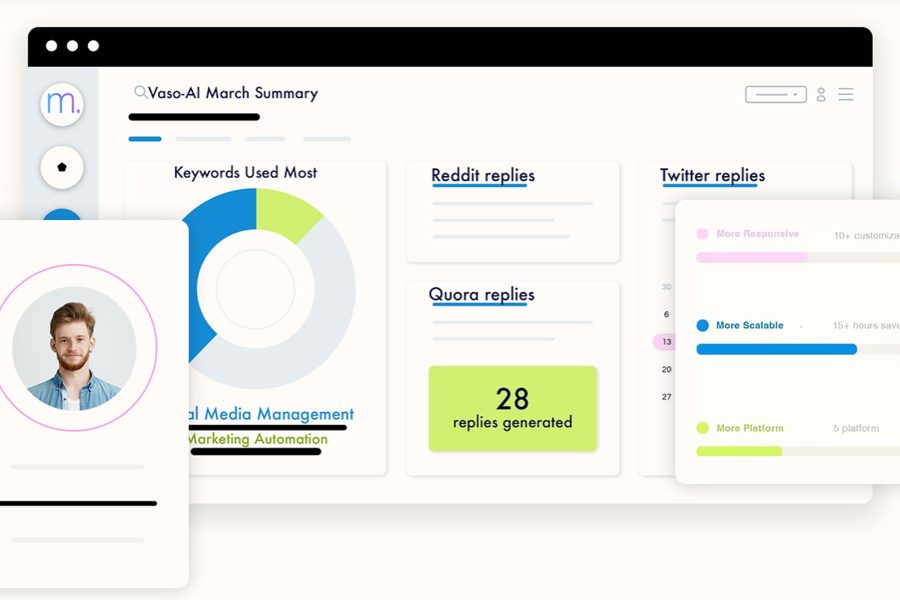

At the core of Vela’s operations lies the Vela AI Suite, a comprehensive platform automating various aspects of venture capital, including sourcing, evaluation, decision making, relationship management, and market intelligence.

On ProductHunt it has ranked 3rd product of the day with more than 300 up votes, on November 30th 2023.

What’s your background, and what are you working on?

I’m an entrepreneur and investor, building a product-led venture capital firm.

What inspired you to start Vela, and what problem were you aiming to solve in the venture capital industry?

I quit Google to start something new with a positive societal impact as AI was going through its first breakthrough moment during the deep learning era in 2016.

As I explored ideas, I bumped into the world of early-stage investing and startups. With some naivete and unreasonable courage, I thought that VCs were not doing a good job in running their own businesses. While investing in innovation, their businesses were not run as innovatively. I found it to be an oxymoron.

As I dug into the problem space, I was thrilled by the idea of accelerating innovation. It fulfilled my mission of creating a positive societal impact through allocating resources to the right breakthrough projects.

I started being obsessed about building mathematical models around this and started perceiving this as a math problem. And I have deeply enjoyed solving these challenging puzzles since I was a kid.

How does Vela differentiate itself from traditional venture capital firms?

I never saw Vela as a VC firm since the beginning. And, we don’t intend to become a traditional VC firm.

We’re simply an AI startup productizing the VC industry, and monetizing its approach through the business model of a VC – creating funds like other VC firms.

We have a product-driven approach to help entrepreneurs start their ideas.

How does Vela use AI in its investment decisions?

In every aspect. We automate whatever humans are doing: thesis building, searching, discovering, analysis, scoring, ranking.

What are some challenges that Vela has faced in using AI in its investment decisions?

Before LLMs, deep learning models were data hungry and had broad insights. This has caused insights to be more generalized. For instance, having a repeat entrepreneur background is positive.

In reality, every startup is unique. Every founder is unique. LLMs are enabling us to reason and work with small datasets, which is a huge breakthrough.

How does Vela measure the success of its investments?

Each investment must return 100x+ return. If it doesn’t, it is a failure.

What are some of the most important things you’ve learned since you started Vela?

Perseverance, mastery and adaptability alongside lots of luck.

What are some of the most essential tools that you use for your business?

Vela AI Suite + Superhuman + ChatGPT

Where can we go to learn more?

Our website has all the info. You can talk with our AI agent to learn more. You can also find all our main social media platforms here, including Twitter, LinkedIn, and ProductHunt.

I regularly interview creators who achieve top ranking on platforms such as ProdcutHunt and Betalist. Check out additional discussions like this on BetaHunt.io. For updates, follow me on Twitter.

Leave a Comment